Silicon Valley expands south for access to skilled engineers struggling to enter the US

Donald Trump’s pledge to clamp down on immigration.

His moves to restrict how many highly skilled immigrants can enter the country may benefit America’s southern neighbour, as technology outsourcers from India, Europe and the US eye Mexico as a place from which to service US clients struggling to recruit software engineers.

Tech Mahindra, one of India’s largest IT service companies, says it will double its operations in Mexico in the next year to 18 months if the US makes it more difficult for Indians to get skilled H-1B visas.

Arvind Malhotra, global head of strategic accounts and South America, said: “We’ve been having several conversations that we want to ramp up the operations in [Latin] America — especially English-speaking operations — because of the current administration.”

It is considering nearly doubling the size of its 110-strong office in Mexico, from which it could send people quickly and cheaply across the border into the US to provide services that are currently done by its large US-based staff. Tech Mahindra last year filed 8,615 applications for H-1B visas according to My Visa Jobs, an immigration consultancy.

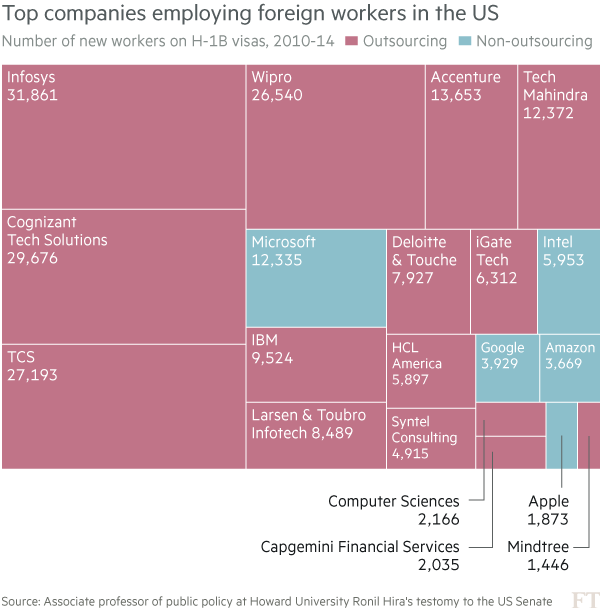

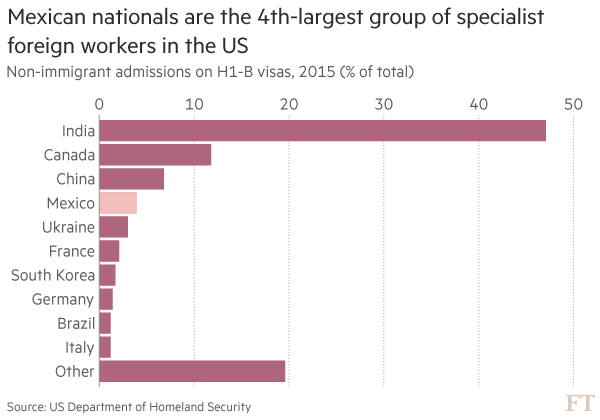

President Trump has targeted the H-1B visa, used heavily by technology outsourcing companies to bring engineers to the US, as part of his “Hire American” agenda. Between 2010 and 2014, the four employers who brought in the most workers on H-1Bs were outsourcers, with Infosys at number one bringing in more than 30,000, according to Ronil Hira, associate professor of public policy at Howard University.

Companies had already complained that the visa was in short supply, as the annual allotment of 85,000 runs out in days. But last month the US president signed an executive order pledging to crack down on H-1B “fraud and abuse” and make applicants prove their skills to a higher level.

While some large US tech brands are exploring expanding in Canada, IT services companies are focusing on Mexico as demand for “nearshore” services soars.

Mexican IT services hit $20bn in 2016 and are set to outpace the growth of the sector in India, increasing 15 per cent year on year, according to HFS Research, which tracks the IT services industry. The US and other clients take advantage of a near timezone, easy border crossing, good technology, and English language skills.

iTexico, an Austin-headquartered nearshoring company, has opened a new office in Aguascalientes and is looking to expand by acquisition. ArkusNexus, another software nearshorer, is expanding its campus just over the US border in Tijuana, building a new 1,000 sq-ft facility. Swiss outsourcer Luxoft says its “stretch goal” is to double the size of its Mexican operations.

Aristóteles Sandoval, the governor of Jalisco, is seizing the opportunity offered by US restrictions on immigration. He toured Silicon Valley earlier this year with the message that the province wants to be a “sanctuary” for highly skilled workers. Jalisco put a full page advert in the US publication Politico, offering to work with tech companies. It is also loosening immigration rules for new companies setting up shop, ditching an old requirement that companies could only have 10 percent, foreign employees.

“We’re putting a strategy together with the Mexican consulate to make it easy for people to come work in Jalisco seamlessly as if they were in Silicon Valley . . . or in their home countries,” said Jaime Reyes, the secretary of innovation in Jalisco. “We will help to establish them with schools and transportation and whatever they need.”

Mexico was already becoming a nearshoring hotspot, with much of the growth centered in Guadalajara, Jalisco’s capital. Indian outsourcers including Infosys and HCL have expanded dramatically in the past five years. IBM has been in the country for 90 years and Oracle is reported to have its own offices to hire software engineers directly. Oracle would not comment.

The state government of Baja California and several business groups in Tijuana have teamed up to bring a proposal to the Mexican Congress later in the year, designed to attract companies who cannot bring enough foreign workers to the US.

David Mayagoitia, chair of the Tijuana EDC, an economic development organization, said the proposal includes allowing companies to import up to 90 percent of their staff, in return for commitments to train Mexican workers and educate Mexican students. Far more people apply to enter the US than gain entry, Mr. Mayagoitia said, creating a huge economic opportunity for Mexico, even if it can only capture 5 percent of those rejected by the US. “If we did that every year for the next 10 years, the Mexican border would be a totally different border,” he said.

Now that many basic tasks that used to be done by outsourcers are automated, many tech companies are using the companies for more advanced software development.

“If there are certain jobs that involve people frequently going across and coming back and you want to reduce that travel cost, it makes sense to be in Mexico,” said R Chandrashekhar, president of NASSCOM, India’s IT trade association.

“If it isn’t possible to have people actually located in the US . . . that would require people in Mexico.”

Angel Sanchez, ArkusNexus chief executive, and co-founder of the Mexican innovation development hub, says nearshore is really more like “no shore”.

“Vendors, partners and a lot of prospects start the day in downtown San Diego or the Soreno Valley and in 45 minutes max they are in Tijuana. They get to work and interact with their team, then we take them all out for street food, tacos, and stuff,” he said. “The same day they can be back home for supper.”

Bismarck Lepe, chief executive of Wizeline, first came to Mexico with his last start-up, online video company Ooyala.

“In 2010, when we opened our operation in Mexico, my board asked me if there were engineers in Mexico. A funny thing to ask. It turned out to be tremendous and incredibly successful,” he said. Many in Silicon Valley still do not realize it is a tech hub, not a “drug or narco-infested area”, he added.

Wizeline has an office in San Francisco but the majority of its employees are in Guadalajara and its Mexican operation is expanding at twice the speed of its US office. It provides software engineering services to multinationals including News Corp and GlaxoSmithKline.

Companies can hire Mexican engineers and bring in experience from abroad. Mr. Lepe said the longest it had taken to get a visa for an employee had been two to three weeks, compared to a much longer process and a lottery for H-1Bs in the US.

“Every company needs to adopt software and there aren’t enough software engineers in the US so we have to look elsewhere,” he said. “The H-1B was a favorable immigration policy for a while but if that changes people need a plan B or C.”

A possibly better, cheaper talent pool

Andrés Villaquirán never had a problem hiring engineers in Silicon Valley on H-1B visas, writes Jude Webber in Mexico City. But the Colombian founder and chief executive of Alkanza, an asset management advisory platform, has found himself increasingly looking south of the border this year as his company expands.

“We’re well funded and we’re in a fairly strong period of expansion. H-1B visas never used to be an issue. But this year, they’ve become one,” he said. “Initially it was the threat of what could happen but now that’s becoming reality.” The Redwood City, California, company has 25 to 30 staff, of whom 10-12 are now based in Mexico, Mr. Villaquirán says. “We’re hoping to reach 40-50 staff over the next year and I think half will be in Mexico.”

He has no plans to quit Silicon Valley entirely. An MIT and Stanford-educated former derivatives portfolio manager at JPMorgan and Credit Suisse, who set up Alkanza four years ago, he still finds it easier to hire data scientists of the right caliber in the US and says access to capital is easier there.

Mr. Villaquirán says he also recruits US staff who do not need H-1B visas. But for engineers, the financial logic is unbeatable. “For every engineer hired in Silicon Valley, I can hire three or four of the same quality abroad,” he says. For him, that means Mexico, chiefly, and a few in Colombia.

Some investors go further, praising Mexican engineers as being better than the talent pool available in the US — not only far cheaper, they say, but also less likely to jump ship as frequently.

Andy Kieffer, who moved to Guadalajara, Mexico’s tech hub, 10 years ago after nearly two decades in the Bay Area, runs Agave Lab, which helps start-ups outsource software engineering. An investor, developer, and accelerator of projects, he has seen calls from start-ups surge in an “alarming fashion” to twice a week from once a month. As one of his clients told him: “Start hiring and don’t stop.”

Source: reuters

The Mazatlan Post